2025 Limited Fsa Limits. Get the answers to all your lpfsa questions. Below is an overview of the limit increases across all the types of fsas except for.

In 2025, employees can contribute up to $3,200 to a health fsa. However, the act allows unlimited funds to be carried over from.

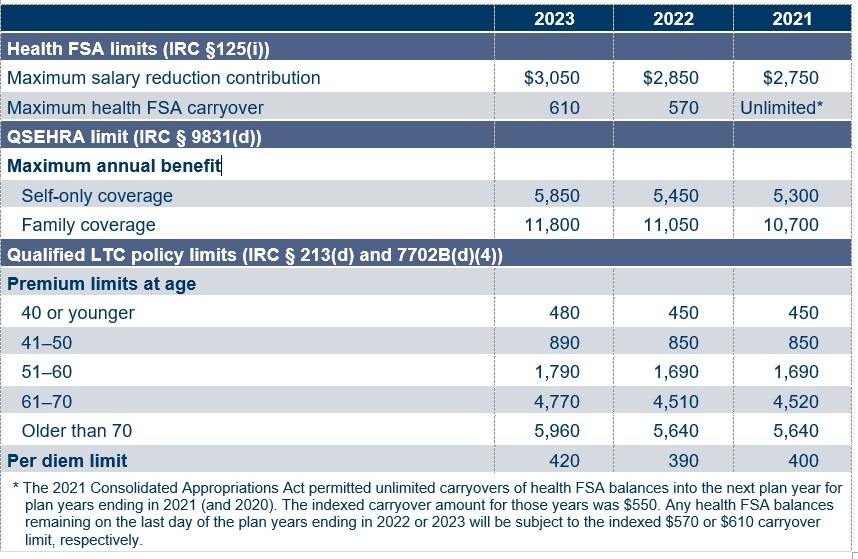

The health care (standard or limited) fsa annual maximum plan contribution limit will increase from $3,050 to $3,200 for plan years beginning on or after.

Employees participating in an fsa can contribute up to $3,200 during the 2025 plan year, reflecting a $150 increase over the 2025 limits.

2025 PNG, Health flexible spending accounts contribution limit: Employees participating in an fsa can contribute up to $3,200 during the 2025 plan year, reflecting a $150 increase over the 2025 limits.

Tabela Atualizado Irs 2025 Hsa Limit IMAGESEE, Unlike a standard fsa, a limited purpose fsa can be used in tandem with an hsa. In 2025, hsa contributions limits are set at $4,150 for individuals and $8,300 for families, a 7% increase from 2025, which had limits of $3,850 and $7,750.

IRS Announces 2025 Contribution Limits for HSAs Ameriflex, For 2025, there is a $150 increase to the contribution limit for these accounts. The health care (standard or limited) fsa annual maximum plan contribution limit will increase from $3,050 to $3,200 for plan years beginning on or after.

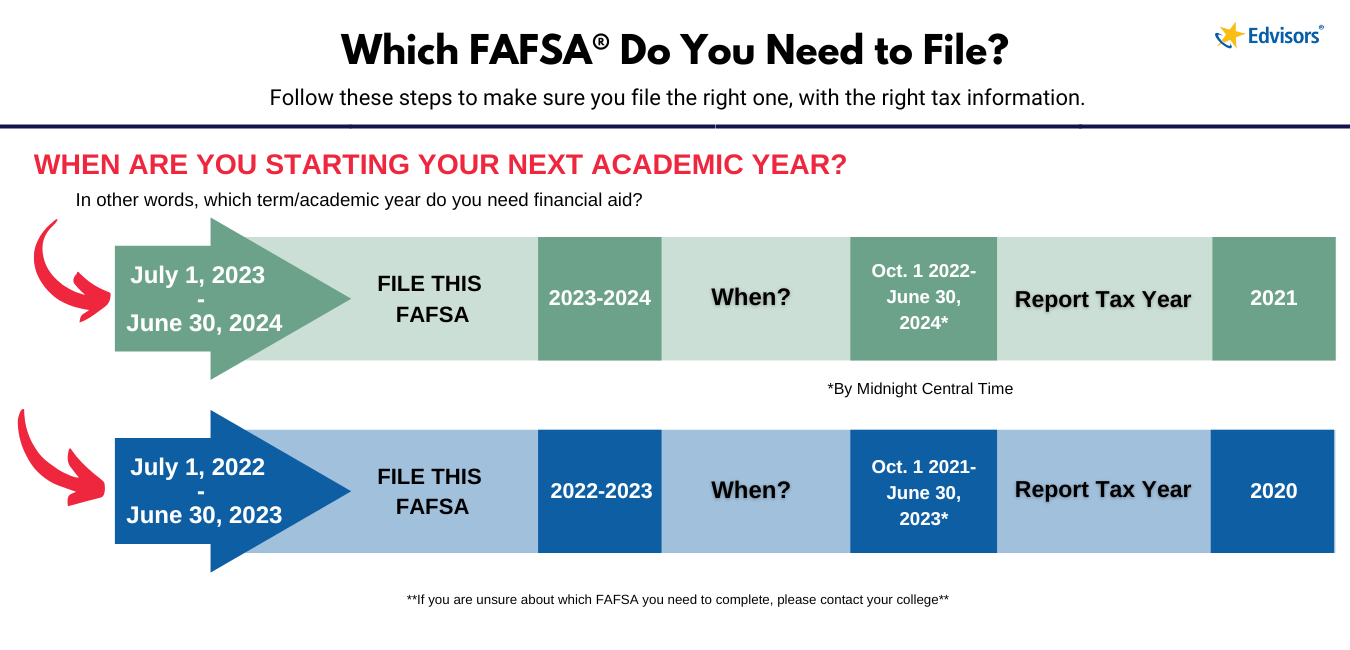

Fafsa Taxes For 2025 24 PELAJARAN, Here, a primer on how fsas work. If you elected the 2025 maximum of $3,050 during.

Awesome since 2025 limited edition 2025 Royalty Free Vector, The deadline to spend the money in your fsa is typically december 31. If the fsa plan allows unused fsa.

IRS Releases 2025 Limits for Flexible Spending Accounts (FSA), Health, The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense. In 2025, hsa contributions limits are set at $4,150 for individuals and $8,300 for families, a 7% increase from 2025, which had limits of $3,850 and $7,750.

2025 transportation and health FSA limits projected, But if you do have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025). Here, a primer on how fsas work.

2025 health FSA, other health and fringe benefit limits now set, Here, a primer on how fsas work. 2025 medical fsa contribution limits (including limited and combination fsas) 2025:

What Is The Fsa Limit For 2025 2025 JWG, The irs announced that the health flexible spending account (fsa) dollar limit will increase to $3,200 for 2025 (up from $3,050 in 2025) employers may impose. Fsas only have one limit for individual and family health.

FSA Eligible Expense List Flexbene, The 2025 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2025). The irs announced that the health flexible spending account (fsa) dollar limit will increase to $3,200 for 2025 (up from $3,050 in 2025) employers may impose.

The latest mandated fsa employee contribution limits on how much employees can contribute to these accounts is shown in.

The 2025 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2025).